You’re in!

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

You’re in.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Discover resources for smarter exporting

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

Senior Economist, Economic and Political Intelligence Centre (EPIC)

In this article:

Economic anxiety surged to levels rarely seen in 2025. While tariff announcements have slowed, trade tension between the United States and its major trading partners remain elevated. This uncertainty disrupted business and household spending plans, leading to a slowdown in economic activity towards late last year.

Hiring eased across the continent and is expected to remain subdued in 2026. Businesses are cautious about making major investments until the Canada-United States-Mexico Agreement (CUSMA) review—scheduled for this summer—is finalized.

On the positive side, inflationary pressures are easing across North America. The Bank of Canada has lowered its policy rate to the lower end of its neutral band (a range that neither stimulates nor restrains the economy), while the U.S. Federal Reserve (Fed) and Mexico’s central Banxico are expected to cut interest rates further this year.

Still, everyday essentials, including coffee and beef, remain costly, straining lower-income households. Tariff-related uncertainty adds to financial stress, especially for families already burdened with high debt. Housing affordability is another major challenge, with sky-high prices and elevated mortgage rates slowing new home construction—particularly in the U.S.

North America’s outlook is just one piece of the puzzle. Explore EDC Economics’ latest Global Economic Outlook for insights on global growth, trade tensions, interest rates and currency trends—critical intelligence for Canadian exporters navigating uncertainty.

With growing risks, Canadian companies face new challenges. EDC’s Global Economic Outlook offers insights to help you make better business decisions.

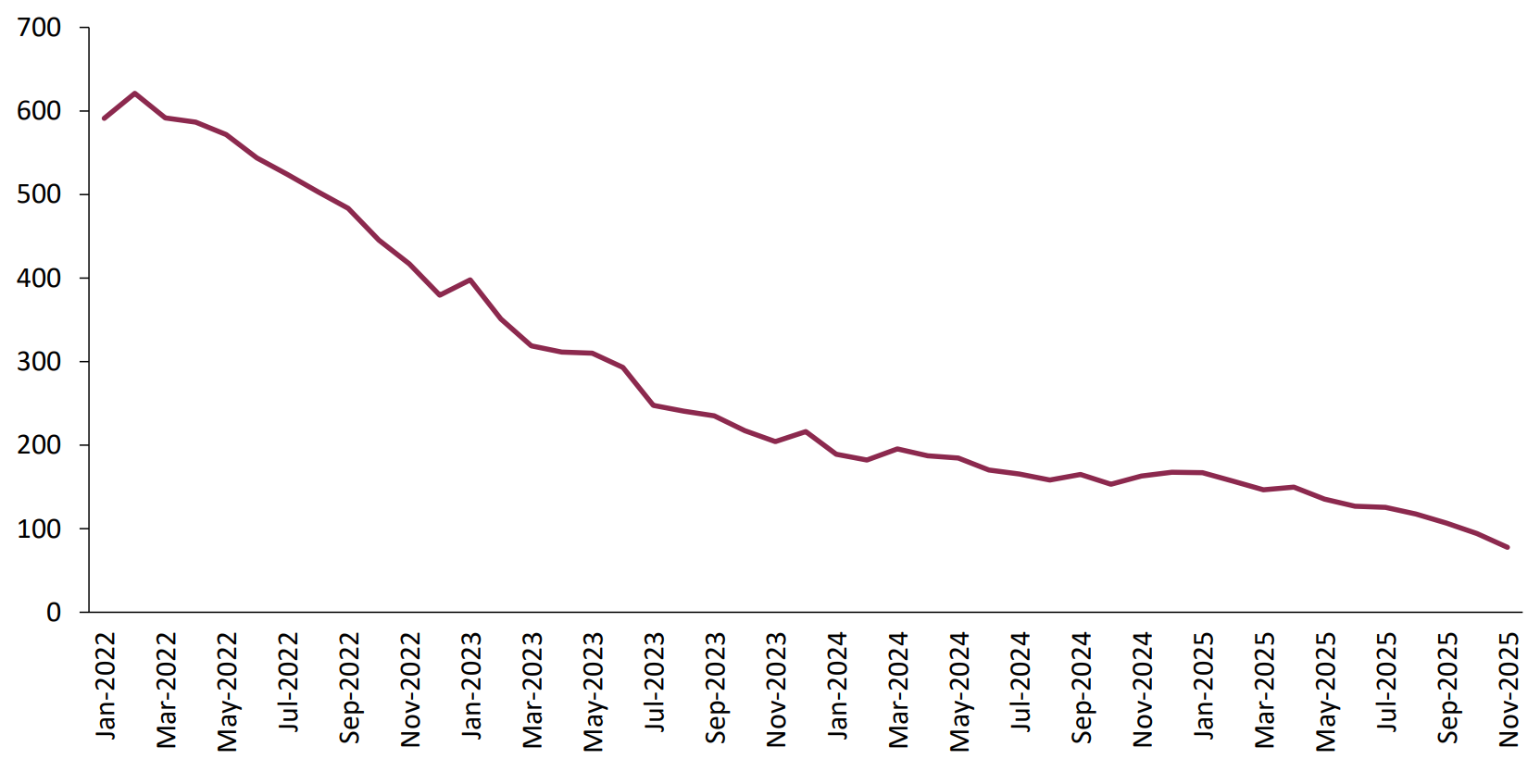

Affordability remains a chief concern for many American households. Slowing job gains, rising unemployment and weak consumer confidence are curbing discretionary spending. (See chart). Non-farm payrolls averaged just 49,000 per month in 2025—down nearly two-thirds from 2024. The jobless rate rose to 4.4% in December.

12-months moving average, in thousands

Sources: Haver Analytics, EDC Economics

Housing affordability is worsening as mortgage rates, home prices and rents remain elevated. Soaring insurance (+7% in November) and electricity costs (+6.9%) add to household strain. Consumers are taking on more debt, which will likely constrain spending in 2026. In our assessment, mortgage rates and housing prices are unlikely to return to pre-pandemic levels.

Tariffs on Canadian lumber and wood products—up 30%-50%—have added roughly US$9,000 to the average U.S. home price, stifling new construction. Immigration crackdowns are also reducing the supply of skilled workers, pushing wages higher.

Business investment is slowing as uncertainty persists. Clean energy projects worth $32 billion were cancelled in 2025, impacting an estimated 40,000 jobs, and offshore wind leases were paused. While new projects are in the pipeline, clarity on tariffs and policy is needed before shovels hit the ground. Investment growth in 2026 is expected to be half the pace of the last five years.

With inflation within the Fed’s target range and labour market weakening, the Fed is expected to cut rates further by another 50 basis points this year to stimulate demand. Real gross domestic product (GDP) growth is forecast to slow from an average of 3.6% (2021-2024) to about 2% (2025-2027).

Canada enters 2026 facing significant tariff headwinds. The U.S. imposed steep duties—50% tariff on steel and aluminum, 10% on energy and potash, and 25% on other non-CUSMA-compliant exports. China followed with punitive tariffs, including 75.8% anti-dumping duties on Canadian canola seed, 100% tariff on canola oil, meal and pea and a 25% tariff on seafood and pork, slashing Canadian export volumes by double digits last fall. While the plunge in Canadian exports has stabilized, the momentum heading into this year is tepid.

To counter these challenges, the federal government launched the One Canadian Economy strategy to remove interprovincial trade barriers and accelerate infrastructure development. The removal of interprovincial trade barriers could unlock $110 billion to $200 billion in annual growth.

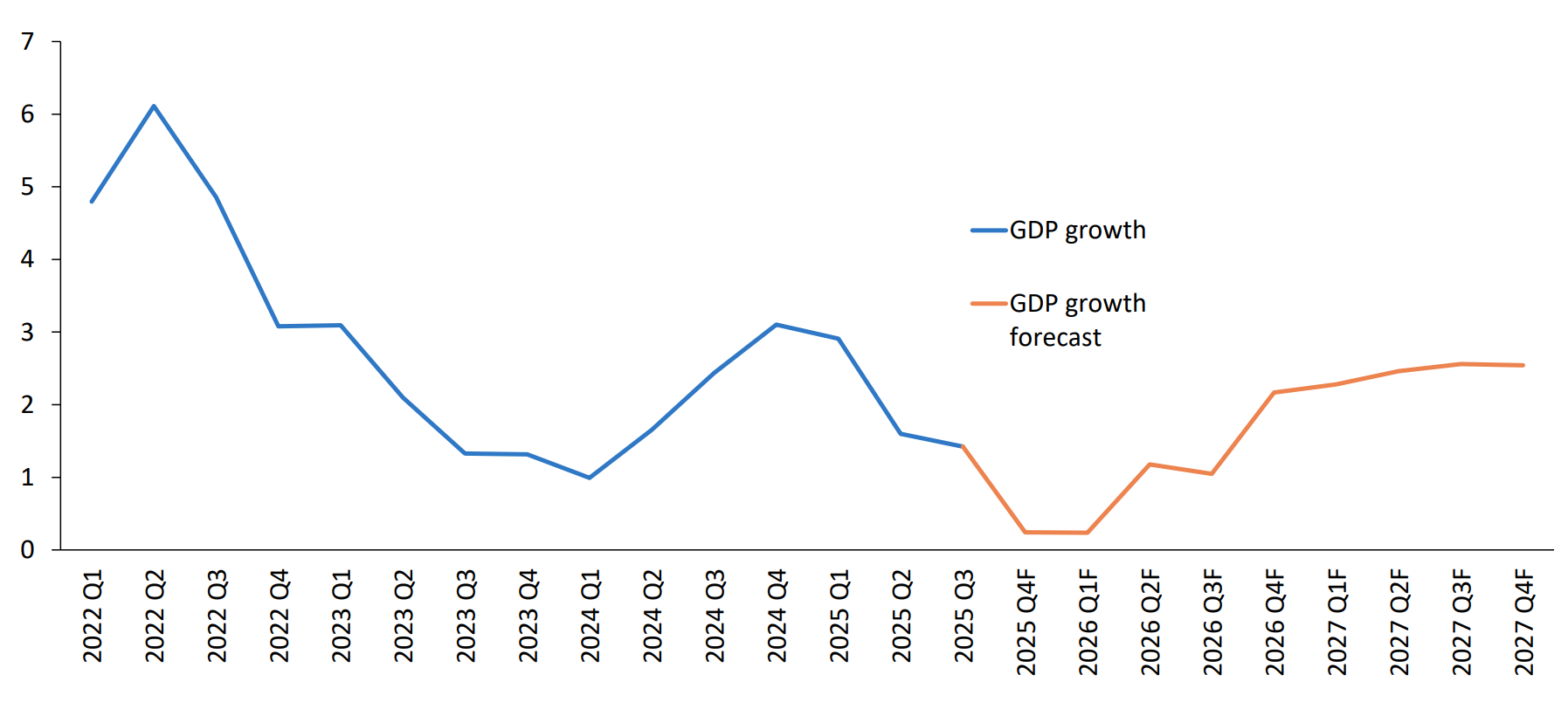

Fiscal measures in the federal budget should help Canada avoid recession, with GDP expected to grow 1.2% in 2026. As the CUSMA review concludes this summer and the new strategy gains traction, growth could accelerate to 2.5% next year (See chart).

The Canadian dollar has strengthened amid tariff-driven shifts in investor confidence, rising more than 5% since March 2025 and projected to reach US$0.72 by year-end.

Real GDP growth, year-over-year % change

Sources: Haver Analytics, EDC Economics

Mexico’s economy continues to underperform due to restrictive policies and state control over key sectors, like energy and critical minerals. Constitutional reforms—such as electing judges through countrywide elections and eliminating autonomous regulators—have weakened institutions and deterred foreign direct investment (FDI). Several announced FDIs have been cancelled or put on hold.

Tariffs are further dampening prospects for businesses looking to set up operations in Mexico. Honda shifted its planned Civic Hybrid production from Mexico to Indiana after the U.S. imposed a 15% tariff on vehicles and parts and 50% tariffs on steel and aluminum. With more than 80% of Mexico’s exports going to the U.S., these measures pose a serious challenge.

GDP growth is forecast at just 1.3% in 2026, rising to 2% next year after the CUSMA review—still below potential (See chart). Banxico will cut rates this year to boost domestic demand, but this will weigh on the peso, which is expected to average MX$20 this year and MX$20.86 in 2027.

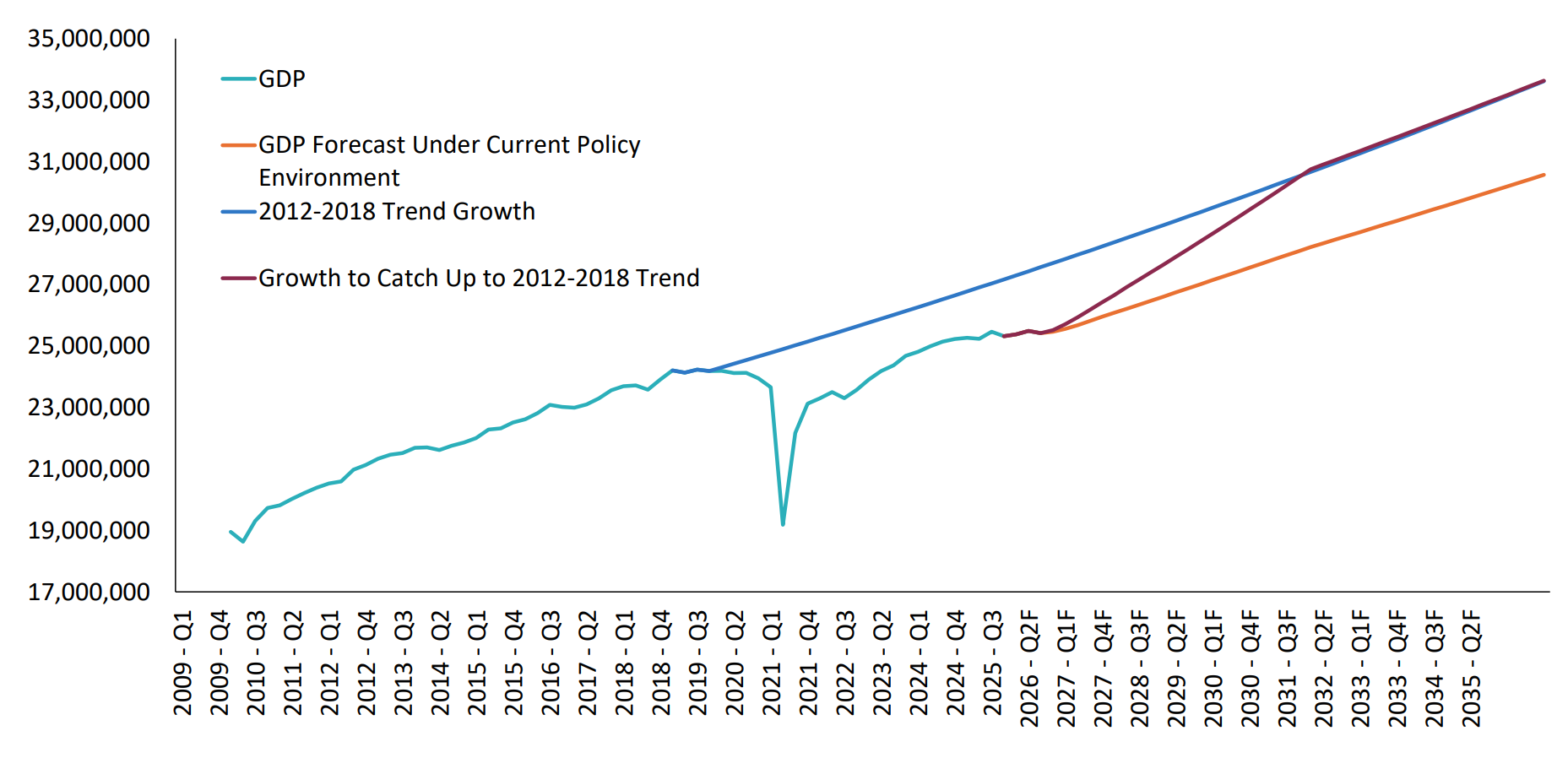

Real GDP, millions of 2019 peso

Sources: Haver Analytics, EDC Economics

EDC offers practical solutions to help Canadian businesses navigate uncertainty—from market intelligence to financing and risk management tools. Our experts provide guidance and connections to help exporters adapt, compete and grow in a complex global environment.

New to EDC? Take a quick assessment to see how we can support your business.

Already an EDC customer? Stay informed on U.S. market conditions and Canada-U.S. trade issues by contacting your EDC relationship manager or calling 1-800-229-0575

Senior Economist, Economic and Political Intelligence Centre (EPIC)

Prince Owusu - LinkedIn

Canadian firms adapt cross-border M&A amid U.S. economic and trade policy uncertainty.

2026 outlook: Fragile growth, tariff volatility and global trade risks.

Survey hits near-record low as Canadian exporters adapt to global pressures

EDC’s Economics team identifies the challenges and opportunities facing Canadian companies, including the impact of COVID-19, global protectionism, inflation, climate change and social unrest.