Service exports boost Canada’s economy and global brand

Author details

Ryan Fung

Junior associate, Economic and Political Intelligence Centre (EPIC)

Many people think of tangible goods when they hear the word “exports.” But the fast-growing service sector contributes significantly to the Canadian economy. In fact, service exports totalled $161.2 billion in 2022, generating 12.1% of Canada’s gross domestic product (GDP).

Exporting services also helps expand the global presence of Canadian businesses, remains a strong driver of job creation, and has quickly rebounded from the COVID-19 pandemic.

What are service exports?

Any service provided by a person or business from one country to a person or business in another country is a service export. Many services are produced in Canada before final sale to a global customer. They include product design, marketing, tourism, software development, logistics support, and financial services.

In fact, many exporters of goods are also service exporters if their products involve after-sale services such as installation, maintenance, training, and knowledge transfer. Because proximity to the customer is vital to the success of many of these services, an increasing number of service-producing companies are establishing a local presence in international markets. Global sales volumes of Canadian service enterprises have had a compound annual growth rate of 12%—double the sales volumes of goods (6%) from 2012-2020.

You should also check out

Get the latest market intelligence to manage trade volatility and tariffs and find opportunities for growth.

What are examples of service exports?

Service exports are vital to the Canadian economy. The Top 5 highest grossing industries are:

1. Travel and tourism. This high-earning sector generated $31.7 billion in revenue in 2022. It encompasses personal and business travel, which was the hardest-hit sector during the COVID-19 pandemic.

2. Technology services. This category is becoming increasingly important for Canada, having generated $26.5 billion in export sales in 2022. It includes data management and cloud computing services, software, research and development (R&D), information communications technology (ICT) and other information technology (IT) services.

3. Professional and management consulting. Taking advantage of Canada’s highly educated workforce, consulting service exports have been growing consistently, totalling $24.4 billion in sales in 2022

4. Transportation and logistics. Due to our country’s expansive size, Canada has several companies in the business of moving goods, whether by ship, rail, air, or truck. Export sales in transportation and logistics totalled $18.9 billion in 2022.

5. Financial services. These exports include banking, insurance, investment, and wealth management, garnering $15.6 billion in sales in 2022. Canada’s strong and well-regulated financial sector helps make us a leader in this space.

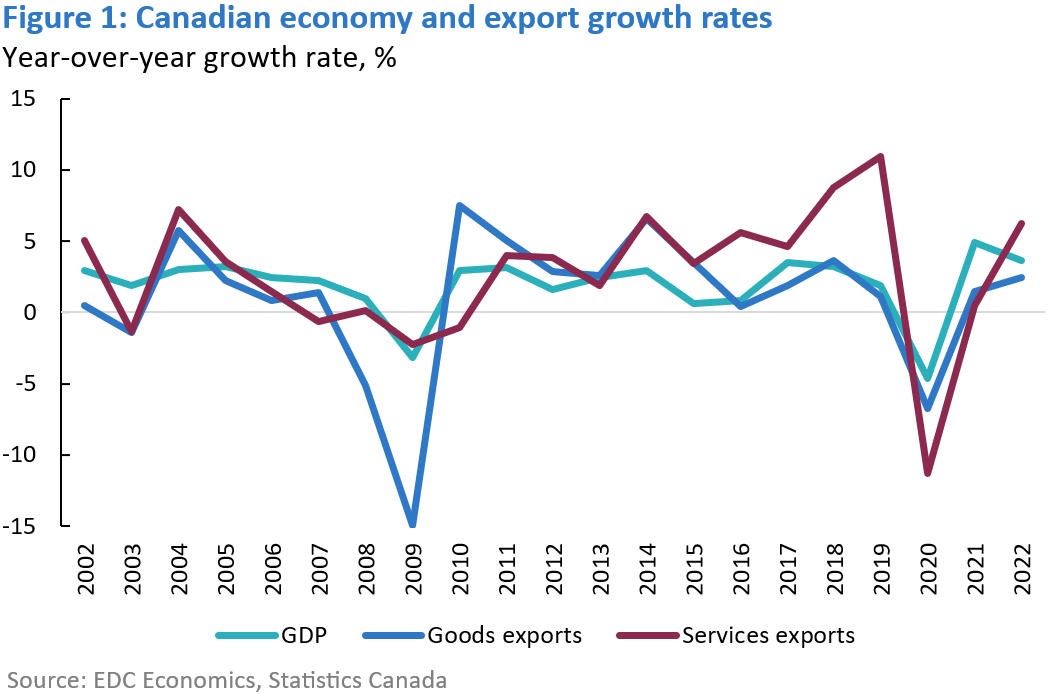

Service exports will continue to cement their importance to Canada’s economy. Although the majority of Canadian exports are still goods, like commodities and manufactured products, Canadian service exports have grown at a much faster rate, and even faster than Canada’s GDP growth—a 5.1% compound annual growth rate from 2002-2022, compared to goods exports (1.8%) and Canada’s GDP (3.7%).

How have service exports rebounded from COVID-19?

Despite the negative effects of the pandemic on global trade, Canada’s service exports have recorded a stellar recovery. The value of our service exports in 2022 was 7% higher than in 2019, and 24% higher than in 2020. In fact, service industries were the main driver of Canadian growth in 2022—supported by the removal of COVID-19-related restrictions around the world—and service exports were a key contributing factor.

Canada’s post-pandemic growth in service exports has outshone that of many advanced economies, outperforming the United States, Italy, Japan and Australia—the latter two countries haven’t even reached our 2019 levels yet.

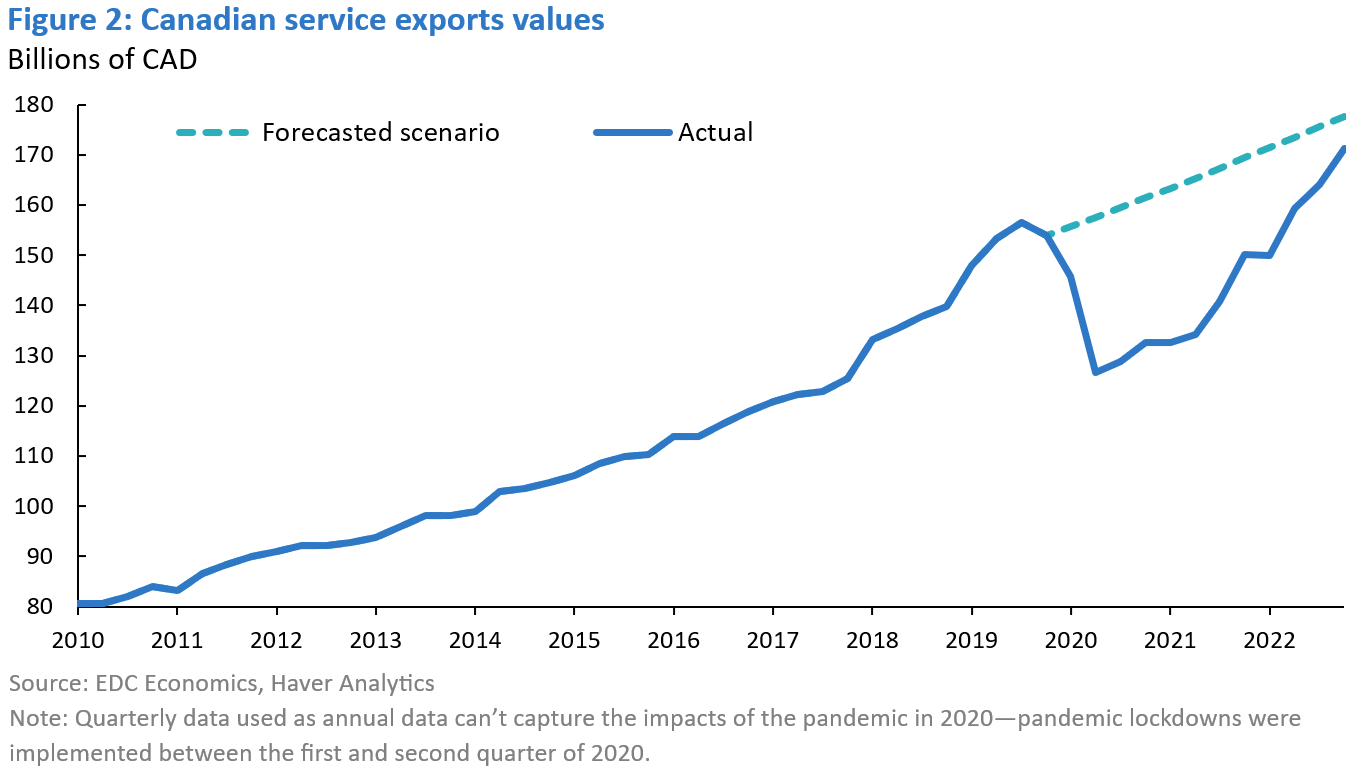

Despite this growth, Canadian service exports are still lower than the pre-pandemic growth trend. Figure 1 shows the actual value of service exports and the forecasted value of a conditional scenario if the COVID-19 pandemic never happened. The value of service exports in 2022 remains 9.5% lower than its forecasted value under the conditional scenario.

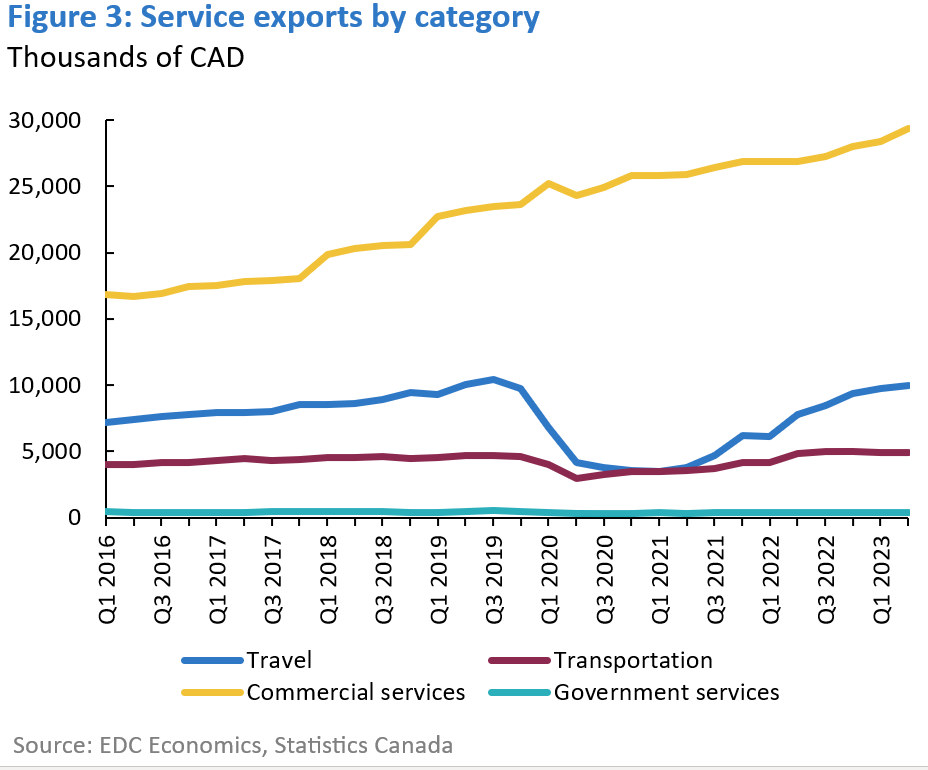

Nevertheless, exports across all major service sectors have increased since 2020, with Canadian travel and transportation exports reaching 2019 levels. Meanwhile, the export of Canada’s commercial services stayed resilient throughout the pandemic—a few sectors even recorded growth. This resilience could be attributed to the ease of transmitting commercial services through the internet or digital sources; as opposed to travel and transportation services, which involve the physical movement of people across borders in providing or consuming the service. The advancements in digital platforms and communications during the pandemic could also underlie the strong export growth of Canada’s telecommunication, computer, and information services sectors.

You should also check out

Rapidly growing sector remains resilient despite turbulent headwinds

Yet, travel services have been the main driver of export growth in 2022. The removal of COVID-19-related restrictions worldwide has enabled travel services to hit $31.7 billion in exports in 2022, growing a whopping 75% from 2021. Transportation service exports, which were also impacted by physical restrictions due to COVID-19, increased faster than service exports overall with a 27.8% growth rate.

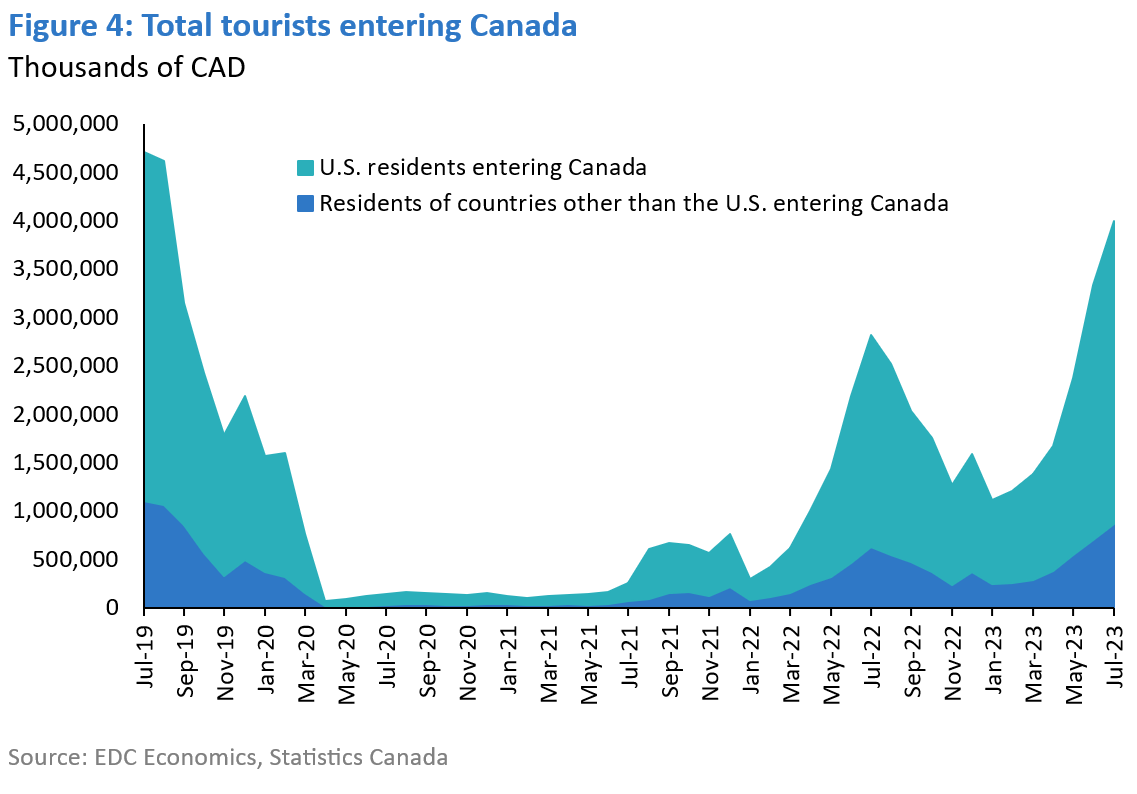

Travel services are still below pre-pandemic levels, with around 18.7 million travellers entering Canada from January to August 2023, compared to 22.9 million in the same timeframe in 2019. The trend of post-pandemic “revenge travel”—to “get revenge” at COVID-19 for keeping society trapped in lockdowns and make up for lost travel opportunities—suggests that travel services will continue to increase. Already, more than four times as many travellers visited Canada in 2022, compared to 2021. Of these visitors, U.S. tourists accounted for 77.9% of total visits to Canada, outpacing growth of tourists from the rest of the world. This could be attributed to the high price of fuel that’s making air travel more expensive, in turn, making travel to Canada more pricey and less attractive for non-U.S. tourists.

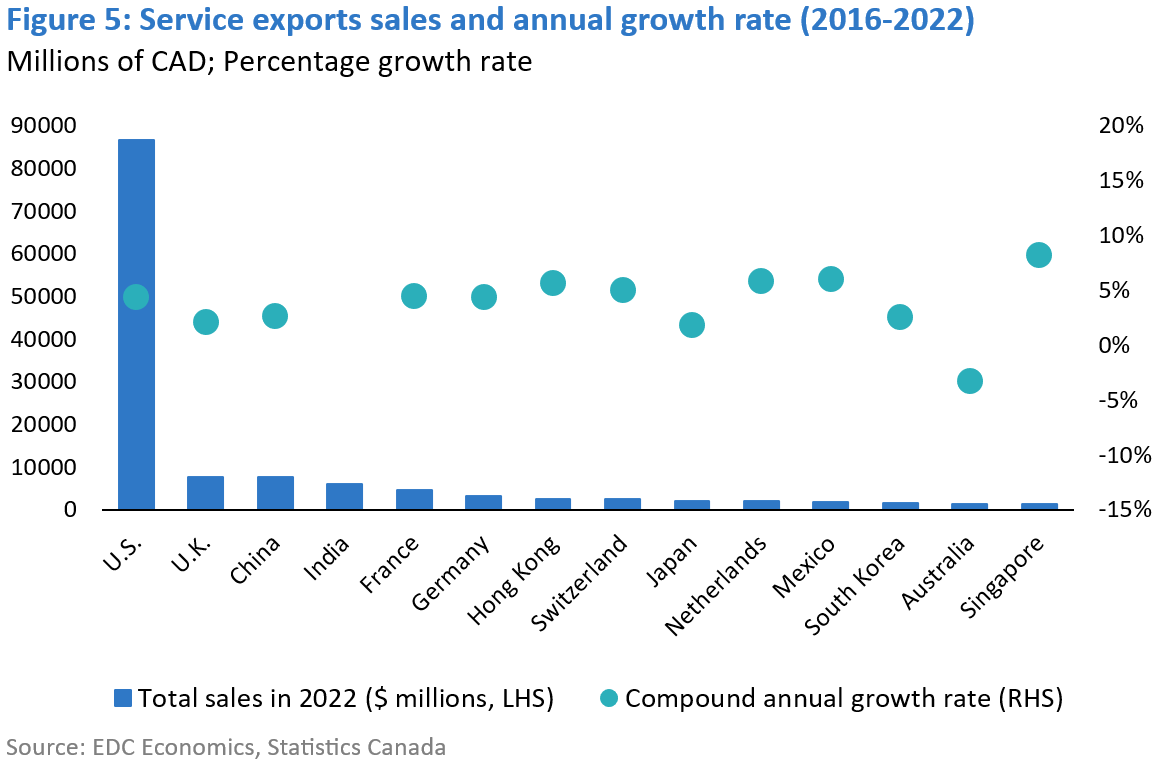

Opportunities for service exports

In 2022, 54% of Canadian service exports went to the U.S., while 58% of service imports came from the U.S. The European Union (EU) was the second-largest market for both service exports (12%) and imports (13%), but lags significantly behind the U.S. Although service exports to the U.S. made the largest contribution to service export levels (+$8.9 billion), it posted slower growth than service exports overall. In fact, the markets exhibiting the largest growth of Canadian service exports from 2016 to 2022 were in India, with an annual growth of 20%, followed by Türkiye (8%), Singapore (8%), Mexico (6%) and Brazil (6%). This shows that there are incredible opportunities for Canadian service exports in markets other than the U.S., particularly in Asia and Latin America.

An interesting observation is that the share of small- and medium-sized enterprises (SMEs) that exported services experienced significant growth since 2011, with small and micro businesses (one to four employees) more likely to export services than larger firms.i While the share of SMEs exporting services grew, the share of SMEs that exported goods barely changed. This may be attributed to services being more knowledge-intensive, making use of business models that require only a few skilled employees to expand into international markets.

In addition, women-owned exporting firms are more concentrated in service industries compared to men-owned and equally-owned exporters.i In contrast, men-owned firms are dominant across sectors that export goods. This shows that the opportunities in service exports could allow small-sized and women-owned enterprises to expand and thrive.

In summary

Service exports are an important part of Canada’s economy, providing $161.2 billion to the country’s GDP in 2022 (12.1% of total GDP), and are expected to spearhead Canada’s export growth. Exports in service sectors also support and present opportunities for small and micro firms, and women-owned businesses. Although service exports were impacted significantly by the COVID-19 pandemic, data has shown that exports in all service sectors are close to surpassing pre-pandemic levels. With such growth potential and positive impacts to our economy, service exports provide myriad opportunities for Canadian businesses.

i According to Global Affairs Canada’s State of Trade 2023 report