What’s New

Credit insurance help & support

We’re working hard to listen to your feedback and make improvements to the Portfolio Credit Insurance portal so it’s easier and faster for you to manage your insurance with EDC. Read below to better understand the changes we’ve recently made, and how they impact you.

Recent updates

June 2024

Highlights

New two-factor authentication process

EDC is making digital platform updates to enhance the protection for your personal and business information through a two-factor authentication (2FA). This type of authentication sends a unique code to your email address, which, combined with your account password, verifies your identity.

To update your password, please follow the instructions below :

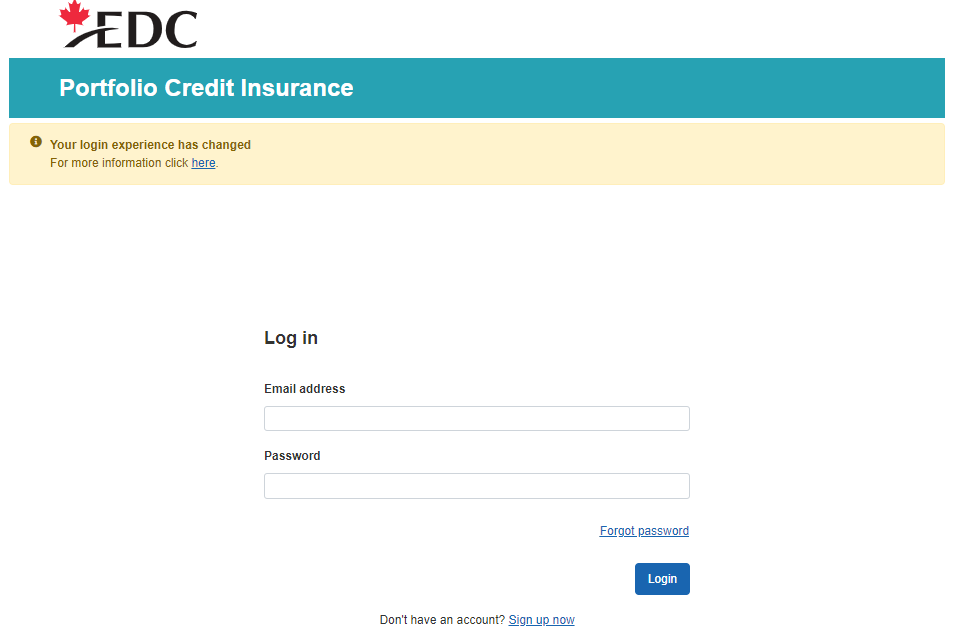

1) Log in with your email address and password.

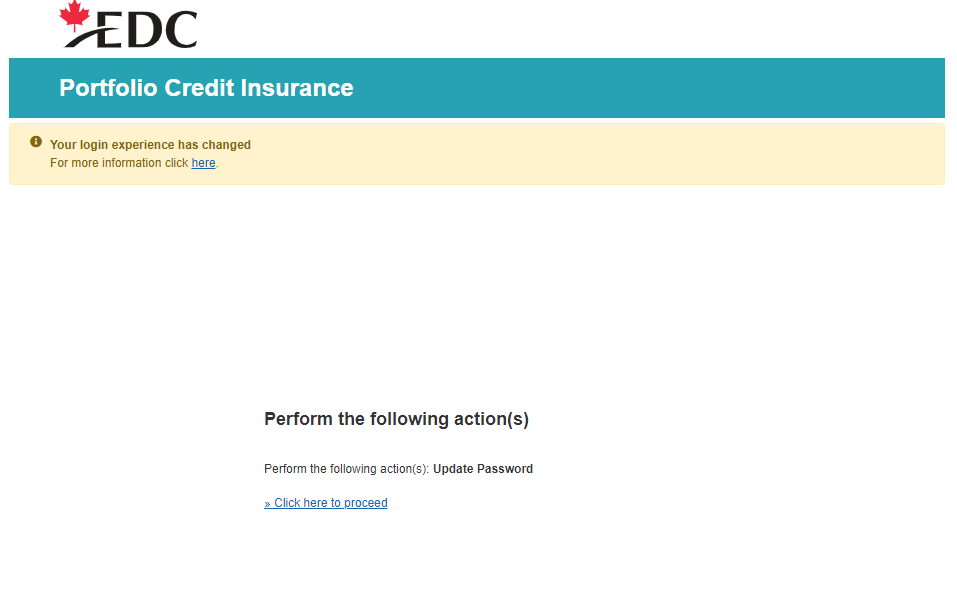

2) Once you log in with your current email and password you will be invited to update your password according to the new requirements (12 characters minimum).

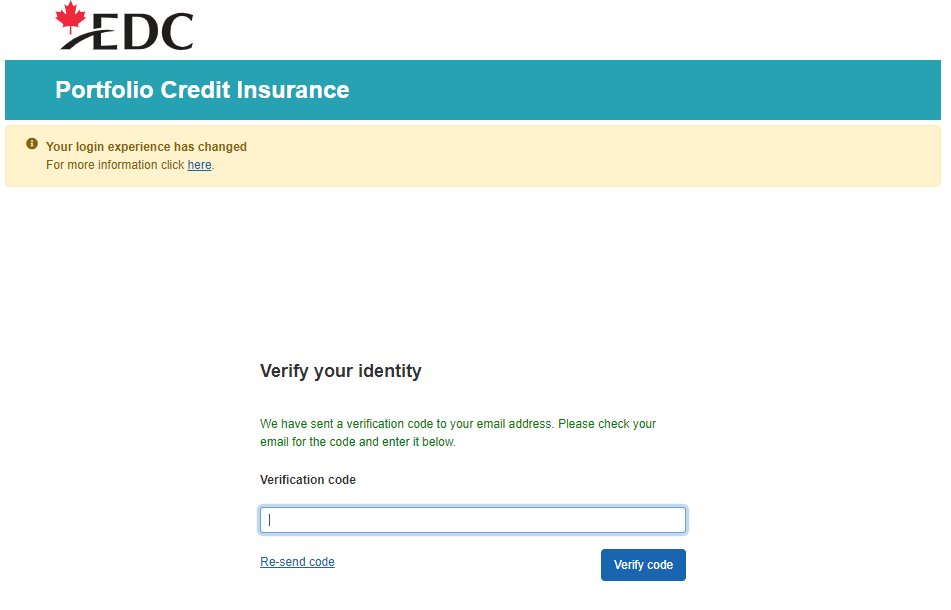

3) Once your password is updated, you will be redirected to the login page. Please enter your email address and new password. Next, the system will send you an email with a code to verify your identity.

4) On the login page, enter the code you receive by email. Now you can access your dashboard and manage your policy as usual.

NOTE: This password change is only applicable to the policy portal for your Credit Insurance. Your billing portal and MyEDC.ca accesses are unaffected, if applicable.

There are a few places to look if you have not received the two-factor authentication email:

- Please check your spam and junk email folders to see if this is where the email landed.

- Try searching your entire email folder for a message from the sender “support@edc.ca”.

- If neither of the above suggestions locate the two-factor validation code email, your company’s VPN system / firewall may be blocking the message from arriving to your inbox. Please work with your internal IT department to allow the message to arrive to your inbox.

If problems persist, your IT administrators can call us at 1-800-229-0575 or send an inquiry to resolve, as this may be a result of your organization’s firewall rules.

January 2022

Highlights

Portfolio Credit Insurance (PCI) invoice payments

An FAQ section related to payment of PCI invoices.

Payments

We’ll provide you with a monthly Statement of Account. You can also access your PCI invoices for your export and domestic Statement of Account balances on the EDC portal.

If there’s a broker on your policy and/or you have directed us to pay a claim to your financial institution, the broker is copied on your Statement of Account.

If you have a Direction to Pay established with your financial institution, they will be copied on all your late payment notifications.

Information related to a PCI policy will only be shared with third parties where you’ve given formal consent to do so.

Starting on Jan. 1, 2022, ALL export and domestic policies with an overdue outstanding balance began to accrue interest. If you have an outstanding balance, you’ll start seeing interest charged on your February 2022 Statement of Account. The interest rate you’re charged is explained on all invoices and Statement of Accounts.

All invoices are due per the invoice terms.

If your Statement of Account becomes delinquent, you’ll be advised. You’ll receive two courtesy overdue notices; one after your invoice becomes 3 days overdue and another when your invoice becomes 15 days overdue. If left unpaid, you’ll receive a notice of policy cancellation 45 days past the original due date. If the delinquency isn’t resolved within 15 days, your policy will be cancelled.

Financial institutions, brokers and policy-holders can call EDC’s Customer Care team (CCT) with any questions. They can be contacted via email at support@edc.ca or they can be reached between 8 a.m. and 8 p.m. ET, Monday through Friday, by calling 1-866-716-7201.

Directions for how you can pay the outstanding amount due are listed in your Statement of Account on the second page. Acceptable payment methods include:

- Online banking (Canadian funds only)

- Bank wire transfer

- Automated clearing house (ACH) and electronic fund transfer (EFT)

- Online credit card payment via Visa, Mastercard and American Express*

When making a payment, you must indicate your policy number in your payment information. If you have more than one policy, payment must be made separately for each policy. Unless specified, we’ll apply payment to the oldest invoice first.

* EDC’s online credit card payment was launched in November 2021. You must refer to a recent (after Nov. 1, 2021) Statement of Account to access the credit card payment link.

For fast payments, follow these steps:

- Click on the link on your email invoice or statement of account to navigate to the payment page.

- Confirm your company and policy details, and confirm the amount to be paid.

- Navigate to the payment screen and provide your credit card details.

When your payment goes through, you’ll receive a confirmation email.

No, we phased out credit card payments by phone in November 2021.

Yes, all domestic and export PCI policies with an overdue outstanding balance accrue interest as of Jan. 1, 2022.

If payment delinquency is unresolved within the 15-day notice period, your policy will be cancelled.

Yes, if you have signed up for PAD, our system will pull amounts for future invoices only. Invoices that are already outstanding must be paid using another method. Those other methods are outlined on the second page of your invoice and Statement of Account.

Policy

Your PCI policy is delinquent when amounts due under that policy aren’t paid by the due date.

Your PCI policy may not be renewed if the policy is delinquent.

If your PCI policy was cancelled due to delinquency (or any other reason), you can apply for a new policy following EDC’s new applicant process. We will only consider issuing a new policy if you’re in good standing with previously owed amounts.

Claims

If you submit an eligible claim, we’ll offset the claim amount against the premium owed before paying the claim amount. This also applies when your policy has a direction to pay (DTP) or tripartite agreement in place with a financial institution.

Need help?

Speak to our customer care team at 1-800-229-0575 or support@edc.ca.