Using your Credit Insurance Policy

Credit insurance help & support

Discretionary Credit Limit

For coverage to apply to a buyer, you must establish a credit limit for the buyer. A credit limit can be established by obtaining a credit approval from us.

You may be able to establish your own credit limits if your policy contains a discretionary credit limit (DCL). The DCL is the maximum credit that you can approve for a customer without requesting a credit approval from us. For details of on how to do this, consult the discretionary credit limit section of your Coverage Certificate.

Frequently asked questions about Discretionary Credit Limit (DCL)

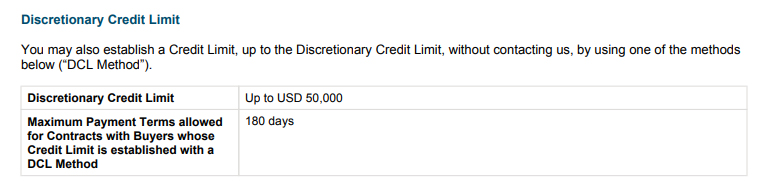

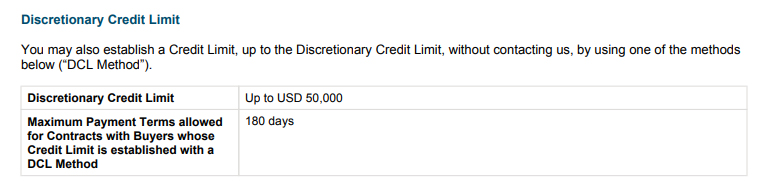

You can check your Coverage Certificate to see the details of your DCL, including the maximum amount available.

If you do not have a DCL, then you won’t see a DCL section on the Coverage Certificate. If that’s the case, you cannot establish a credit limit on your own and must request a credit approval from us. Alternatively, you can speak to our Customer Care team if you are interested in having a DCL.

If you have a DCL, then Discretionary Credit Limit section displays the amount you have available as shown in the example here.

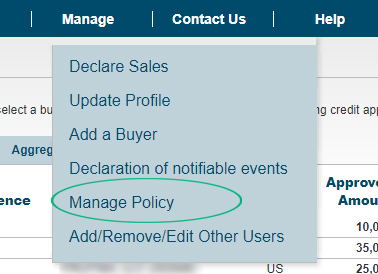

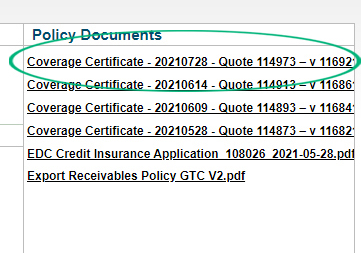

To view your Coverage Certificate, login to the Portfolio Credit Insurance portal.

Then, follow these steps.

1. Select Manage Policy on the Manage menu.

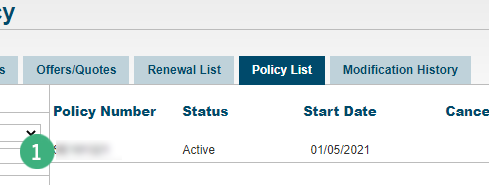

2. Under the Policy List tab, select the policy you would like to review. Select the Policy Details button to view further details.

3. Under the Policy Documents column, view your Coverage Certificate.

To submit a claim on a buyer, you must choose the buyer from your portfolio online.

If you used a DCL method to establish the credit limit on a buyer, it won’t appear on that list. You must manually add the buyer before proceeding with your claim. Instructions for adding buyers manually are available here:

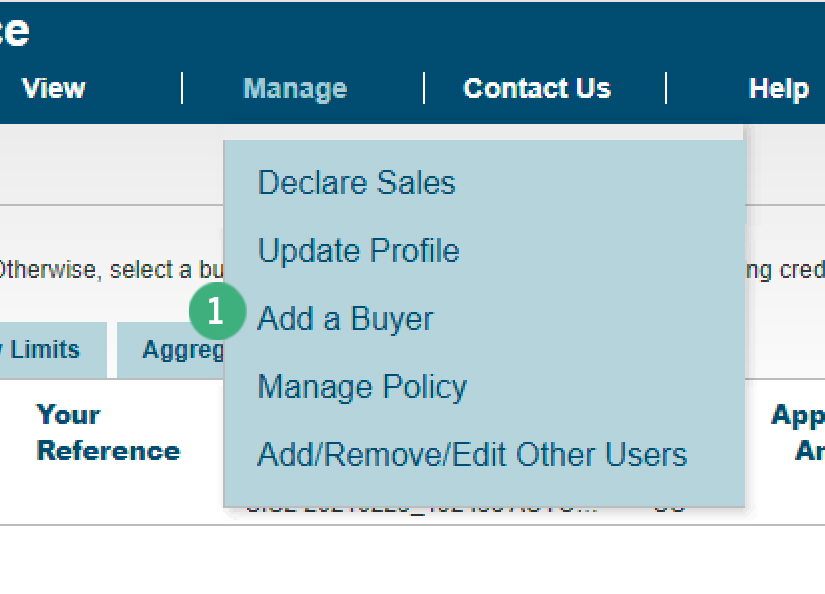

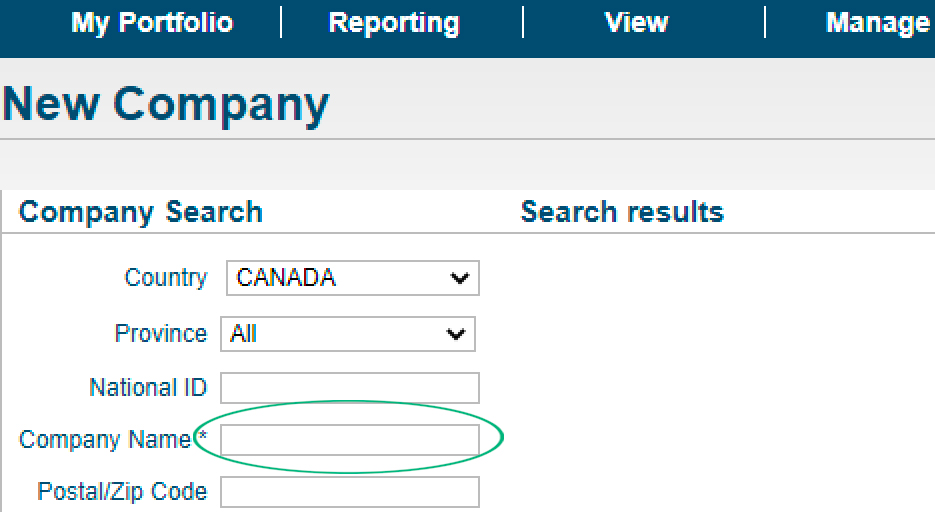

1. Click on Add Buyer on My Portfolio page and search for Company Name.

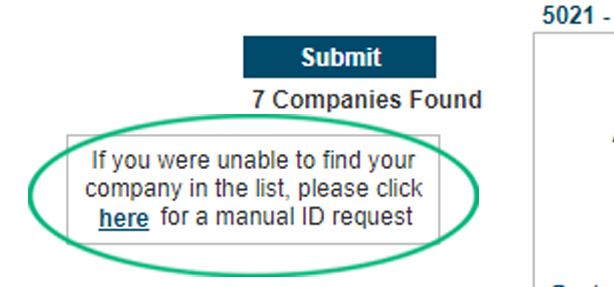

If you are unable to find your buyer from the list, you can manually create the entity by providing the required information as shown here.

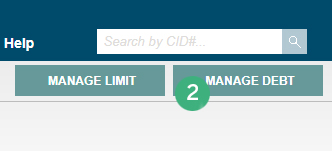

2. Click on Manage Debt button.

If you have multiple policies, you will be prompted to select the policy before the Manage Debt menu is displayed.

If your buyer is Canadian and is covered under both an export and domestic policy, you will need to report the overdue under both policies.

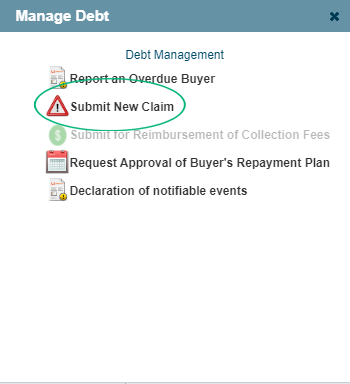

3. Select Submit New Claim from the pop-up window.

4. Complete the four tabs on the Claim Application screen:

a) General Information,

b) Claims Details,

c) Invoices, and

d) Documents/Comments.

a) On the General Information tab, fill out the buyer’s contact information.

b) On the Claims Details tab, fill out all the required fields. Carefully read and scroll through the Collection Service Agreement (if applicable) and the Claim Terms and Conditions. You will need to click the “I Agree” checkbox in order to proceed.

c) On the Documents/Comments tab you can add relevant comments and attach associated documents such as statements of account, proof of debt, proof of shipment and credit information.

* Please ensure you provide us with the documents required by the DCL method you chose for this buyer (see your Coverage Certificate for details).

d) On the Invoices tab you can add line items for each unpaid invoice, credit note or payment. Enter the information into each field, then click on the Add button. A total amount will appear in the fields at the bottom of the screen.

You can also upload your unpaid invoices (in *.CSV file format) by clicking on the Bulk Upload button. Each row in the .CSV file must list the following values in the following order, including the semicolons: Document Number; Issue Date (DD/MM/YYYY); Due Date (DD/MM/YYYY);Amount excl.tax;Amount incl.tax;Currency;Invoice (IN) or Credit/Payment (CN). Here’s a sample template for your reference.

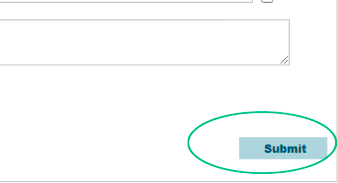

5. When you have completed all tabs, click on the Submit button.

6. The Claims History screen will appear, listing all claims that have been submitted for each policy. The status of the claim just submitted will be a New Claim.

Please note: The processing times for claims and overdues for DCL are the same as regular EDC approvals.

Need help?

Speak to our customer care team at 1-800-229-0575 or support@edc.ca.