Pyrowave: Cleantech’s “One to Watch”

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Discover resources for smarter exporting

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Export Development Canada’s relationship with Pyrowave began in 2017 with the extension of a guaranteed line of credit that helped the company land its first sale with a major U.S. petrochemical producer. EDC currently supports Pyrowave through several financial products and recently made a $1,000,000 strategic co-investment in the company.

In a sector where every innovation is called “disruptive”, Montréal’s Pyrowave is about to go to market with an advanced plastics recycling technology that has the potential to upend the economics and environmental impact of the multi-billion dollar global market for post-consumer recycled plastics.

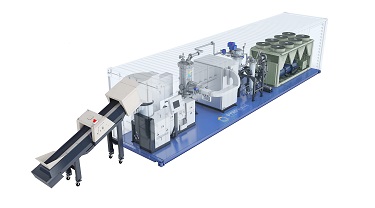

Current plastic recycling processes create a mixed-plastic polymer “sludge” with limited market value and few uses, which is why only about 8% of post-consumer plastic enters the recycling steam. Pyrowave’s patented Catalytic Microwave Depolymerization (CMD) modules take waste plastic “polymers” and carefully breaks their internal links, returning them to their component molecules, or “monomers”, which recovers original market value and can be used to make new plastics with properties identical to virgin.

As innovative as Pyrowave’s technology may be, their business model has generated almost as much interest.

“Rather than competing with the existing recycling ecosystem, we believe we can scale Pyrowave faster by placing our equipment with established recyclers, who already have the infrastructure and understand their markets,” says Jocelyn Doucet, Pyrowave’s CEO. “Our focus will be on helping them be more competitive by giving them access to advanced technologies to generate higher value and increase efficiency.”

EDC was introduced to Pyrowave as it was ready to scale up for sales. The company had received early financial support from several provincial and federal agencies, but capital financing was an ongoing problem that made it hard to take their first order. The situation turned, Mr. Doucet says, once he started working with EDC.

“EDC’s cleantech team saw the potential of our technology even before plastic waste became the hot issue it is now. Hardware-based cleantech is capital intensive and it isn’t easy to attract funding for development and commercialization before you have sales. EDC’s loan guarantee helped us land our first order and launch operations. Later, they supported other financing projects and eventually co-invested $1 million in the company, which has lifted us to a new level of credibility. I see the relationship continuing for a long time.”

EDC believes the unique benefits of Pyrowave’s technology and the strength of its “sell and support” business model makes it a strategic asset that can deliver strong economic value to Canada and major environmental benefits to the world. EDC is proud to identify them as “One to Watch” in Canada’s cleantech sector.

Jocelyn Doucet

Chief Executive Officer

Montréal, Québec

Part 1 of 4 in series

Part 2 of 4 in series

P&P Optica: Cleantech’s “One to Watch”Part 3 of 4 in series

Hortau: Cleantech’s 2018 export starThe global cleantech industry is expected to grow to $2.5 trillion by 2022. The time for Canadian companies to seize these opportunities is now. Here’s how.

How B2B events, trade shows and trade missions help exporters grow globally.

Discover how an export diversification strategy can reduce risk and open new global opportunities.

Learn how U.S. steel and aluminum tariffs impact supply chains and how to mitigate their effects.

Discover key insights to help you understand how to properly use incoterms

Canada’s new Indo-Pacific Agriculture and Agri-Food Office serves up more opportunities for exporters.