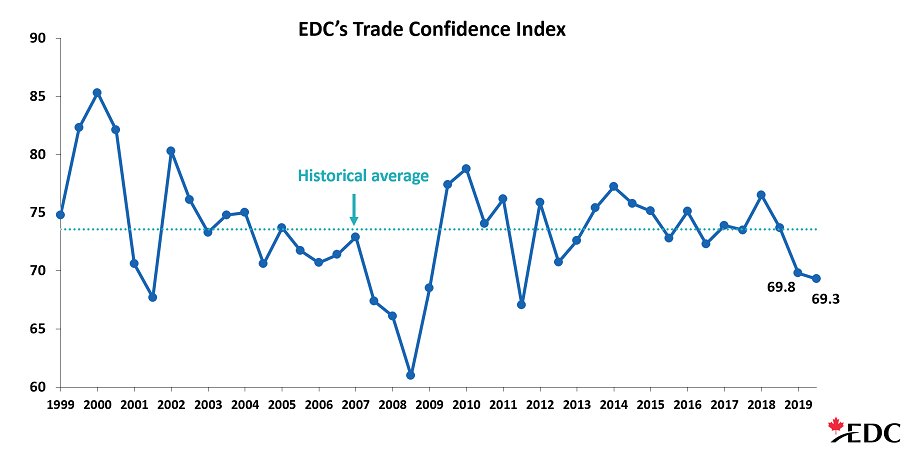

Canadian trade confidence continues to slide

Regional variation

Protectionism remains a persistent concern

U.S.-China trade dispute

Canada stuck in the middle

CUSMA progressing

Recession worries subsiding

Canadian companies investing abroad

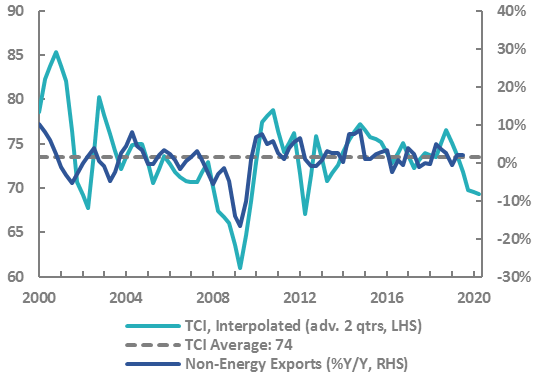

Slow export growth ahead?

EDC’s Trade Confidence Index and Canadian real non-energy export growth

This commentary is presented for informational purposes only. It’s not intended to be a comprehensive or detailed statement on any subject and no representations or warranties, express or implied, are made as to its accuracy, timeliness or completeness. Nothing in this commentary is intended to provide financial, legal, accounting or tax advice nor should it be relied upon. EDC nor the author is liable whatsoever for any loss or damage caused by, or resulting from, any use of or any inaccuracies, errors or omissions in the information provided.