Is your FX hedging strategy working for you?

If you’re an exporter, chances are you either have a foreign exchange (FX) hedging strategy in place, or you’re thinking of implementing one. Smart thinking. In this current volatile market, an FX hedging strategy is essential to protect your profit margins and significantly mitigate your risk of FX losses. To get the most out of your strategy, you need to understand the common FX instruments available and how they can help.

Getting started

Foreign exchange is an important part of every international business. It can be risky, so you need to account for those risks to avoid potentially devastating losses. While fluctuations in the value of the Canadian dollar were an issue before the pandemic, managing market risk is more important now than ever. Not only are companies dealing with increased market risk, some financial institutions are also requiring more security to cover these risks, which means you may have to put up additional collateral on your loans. Supply chains are also being disrupted, making it difficult to know when you’ll receive the supplies you need, be able to ship your products, or more importantly, get paid.

Bottom line: It’s time to start looking at foreign exchange risk management with the same level of dedication and detail as you do other financial risks. When you protect your costs and sales with an FX hedging strategy, you can:

- Be confident in pricing your contracts, knowing your profit margins, and paying your suppliers without the fear of losing money; and

- Accurately budget your revenues and costs in Canadian dollars.

Unfortunately, we can’t tell you the single best approach to use when deciding how to hedge foreign exchange risk. Each company is unique and needs to analyze its hedging needs according to its individual requirements and capabilities. For example, some companies protect only confirmed sales while others protect forecasted ones. Factors such as your risk tolerance, the impacts on your earnings due to exchange rate fluctuations and the predictability of future sales will influence your decision.

At Export Development Canada (EDC), we can outline common FX instruments, how they help mitigate risk, and other ways to ensure you have the working capital you need to go after new business opportunities, both domestically and abroad.

Forwards

Forward contracts are the most widely used instrument by Canadian exporters. They enable you to lock in a fixed FX rate–not necessarily what the exchange rate is right now–on a transaction for a specific date in the future. This can be a good plan if a currency’s value is expected to fluctuate significantly; forward contracts allow you to forecast sales and revenues with relative certainty, which is helpful in building a competitive pricing strategy. The downside is that, on the agreed upon date, you may be obligated to settle your contract or purchase the currency you committed to, even if your customer has yet to pay.

Another type of forward contract is a window forward. With this contract, you can buy or sell currency as many times you want within a certain time period (known as “windows”) to close the contract. Window forwards are more expensive than standard forward contracts, but they make it easier to make payments towards your contract based on when you get paid by your customer.

Options

Currency options give you the right—but not the obligation¬—to buy a certain amount of currency at a future date. Because these options don’t require you to buy or sell foreign currency (unlike forward contracts), they’re highly flexible and often used by companies that bid on contracts. Currency options protect you against foreign exchange risk, while still allowing you to profit from favourable movements in exchange rates. This is why some carry an upfront cost. On the downside, if the currency never shifts in your favour, your cash may be tied up to secure the contract and you can never use the option.

There are a variety of options strategies out there. The major downside is that many are complicated. It’s important to speak with your FX provider to determine the best fit for your company’s risk management strategy.

Both forward contracts and currency options may require you to post collateral to your financial institution, which ties up working capital that could be used to fulfill the terms of your contracts or to take on new growth opportunities. This is where EDC’s Foreign Exchange Facility Guarantee can help.

EDC’s Foreign Exchange Facility Guarantee (FXG)

EDC’s FXG eliminates the need to post collateral as payment assurance for an FX contract, freeing up your cash for operations. This can help you better predict your cash flow and profitability and put your company in a more competitive position.

By providing guarantees, EDC can help companies obtain financial tools to hedge their currency risk, while avoiding restrictions on their working capital.

How does an EDC FXG work?

Simply put, rather than ask for collateral from your business, your FX provider gets a guarantee on the borrowed money from EDC. This means the security required for your foreign exchange contracts is covered and you have liquid working capital, increasing your business stability and leaving you well-positioned to take on new contracts and opportunities.

The cost of this prepaid protection is based on your risk rating and the maximum length of contracts allowed under your FX facility. We’re ready to support your FX strategy—contact us today to get started with EDC’s Foreign Exchange Facility Guarantee.

Product inquiry form

Send us your questions on EDC’s solutions.

Call 1-800-229-0575 or send us a question

Spot rates

Spot rates are another widely used FX instrument. They lock in the value of a currency “at a specific moment in time.” Whether the exchange rate goes up or down before you get paid, you’ll know exactly how much money you’ll get from a sale, and can plan accordingly. It’s important to discuss your preferred rates with your FX provider and have them inform you of currency fluctuations, so you can capitalize on positive market movement and minimize your potential losses.

Currency swaps

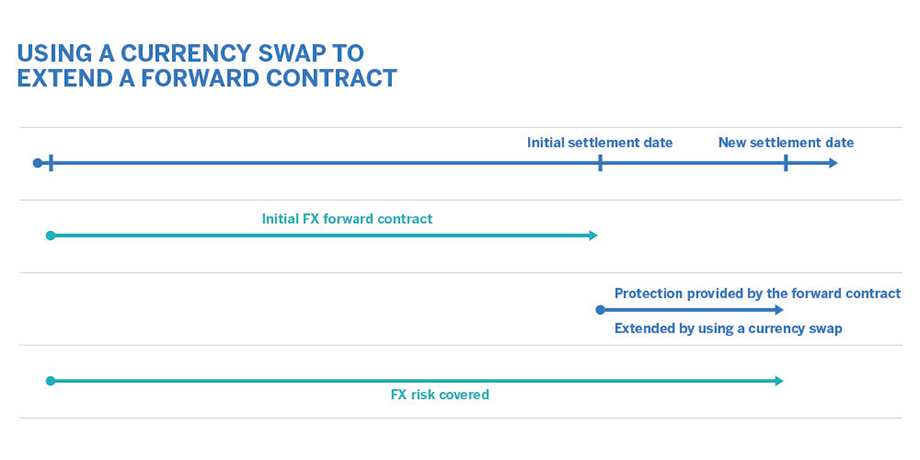

Currency swaps involve the simultaneous selling and buying of a foreign currency and can help companies match receipts and payments. They’re a combination of a spot rate (purchase or sale of foreign currency for delivery within 24 to 48 hours) and a forward contract. There are no direct costs for buying swaps, but some collateral may be required. As mentioned earlier, currency swaps can be used for moving up or extending a forward contract or for matching cash flows (see chart). Swaps are popular with businesses that have currency inflows and outflows at unexpected dates and are extensively used by Canadian companies for cash management purposes.

Summary

All of these FX instruments come with risks. To ensure you’re adequately managing your FX risk, you need to take an active approach that typically involves more than one of the instruments discussed. Currency markets are volatile, so get your financial service provider involved. They’re motivated to help you protect your business against losses due to currency fluctuation.

The best source for daily FX commentary and analysis is your FX provider. If you’d like more information on the currency market, check out these resources:

One thing is certain: If you want to pursue new opportunities, you can’t be tying up your working capital with your FX provider, who may require collateral (sourced from your operating line, general security agreement (GSA) or credit extended by your provider) for FX hedging. For many exporters, the threat of depleting their working capital may be a good enough reason to delay hedging for as long as possible, no matter when the FX risk actually appears.

Norman Faubert is president of Optionsdevises, a Montreal consulting firm that specializes in helping exporters deal with FX issues. “The whole purpose of FX risk management is to protect the company’s most valuable asset—its ability to make money by delivering a product or service abroad.” In Faubert’s view, a business that wants to take control of its bottom line must follow carefully designed strategies for managing FX risk. “EDC’s FXG is a great tool for this. By providing guarantees, EDC can help companies obtain financial tools to hedge their currency risk, while avoiding restrictions on their working capital.”

Norman Faubert is president of Optionsdevises, a Montreal consulting firm that specializes in helping exporters deal with FX issues. “The whole purpose of FX risk management is to protect the company’s most valuable asset—its ability to make money by delivering a product or service abroad.” In Faubert’s view, a business that wants to take control of its bottom line must follow carefully designed strategies for managing FX risk. EDC’s FXG is a great tool for this.

What’s the solution? EDC’s FXG provides a 100% guarantee of the collateral that your financial institution requires. Once the guarantee is in place, your FX provider can utilize EDC’s FXG’s value in lieu of a margin deposit, and you’ll have full access to all of your working capital, allowing you to stay competitive and go after more contracts.

Benefits of EDC’s FXG:

- Protect your profit margin by locking in exchange rates—without tying up your working capital: When you don’t have to post collateral to secure your FX hedge, you’ll have more available working capital, allowing you to take on more opportunities, explore expansion plans, and grow your business.

- Take the guesswork out of FX budget forecasts: By locking in a rate in advance, you’ll be more confident when pricing your products or services, which will increase the accuracy of your cash flow forecasts.

- Increase your borrowing capacity: You can secure FX contracts without posting collateral, making the bank more confident in lending you money against those assets.

- Improve cash flow management: Margin calls (the amount required as collateral for your FX hedge) can be unpredictable. With an EDC FXG, you don’t need to meet those calls until the maximum liability of the guarantee is reached.

- Access to more sophisticated FX tools: By allowing EDC to support the inherent working capital constraints accompanied by advanced hedging, you can book longer FX contracts (up to three years).

Contact EDC today to learn more about our Foreign Exchange Facility Guarantee.

Product inquiry form

Send us your questions on EDC’s solutions.

Call 1-800-229-0575 or send us a question